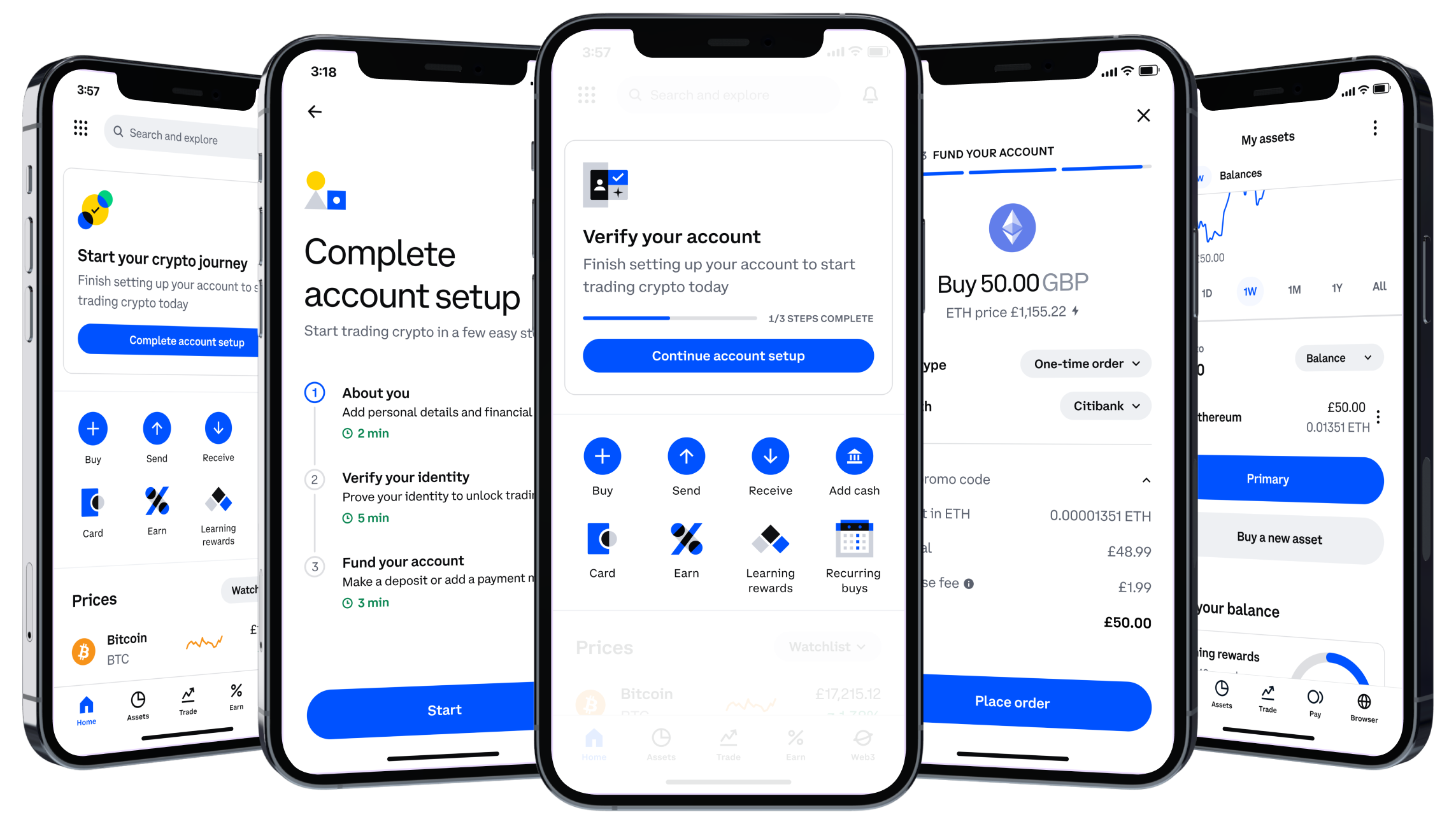

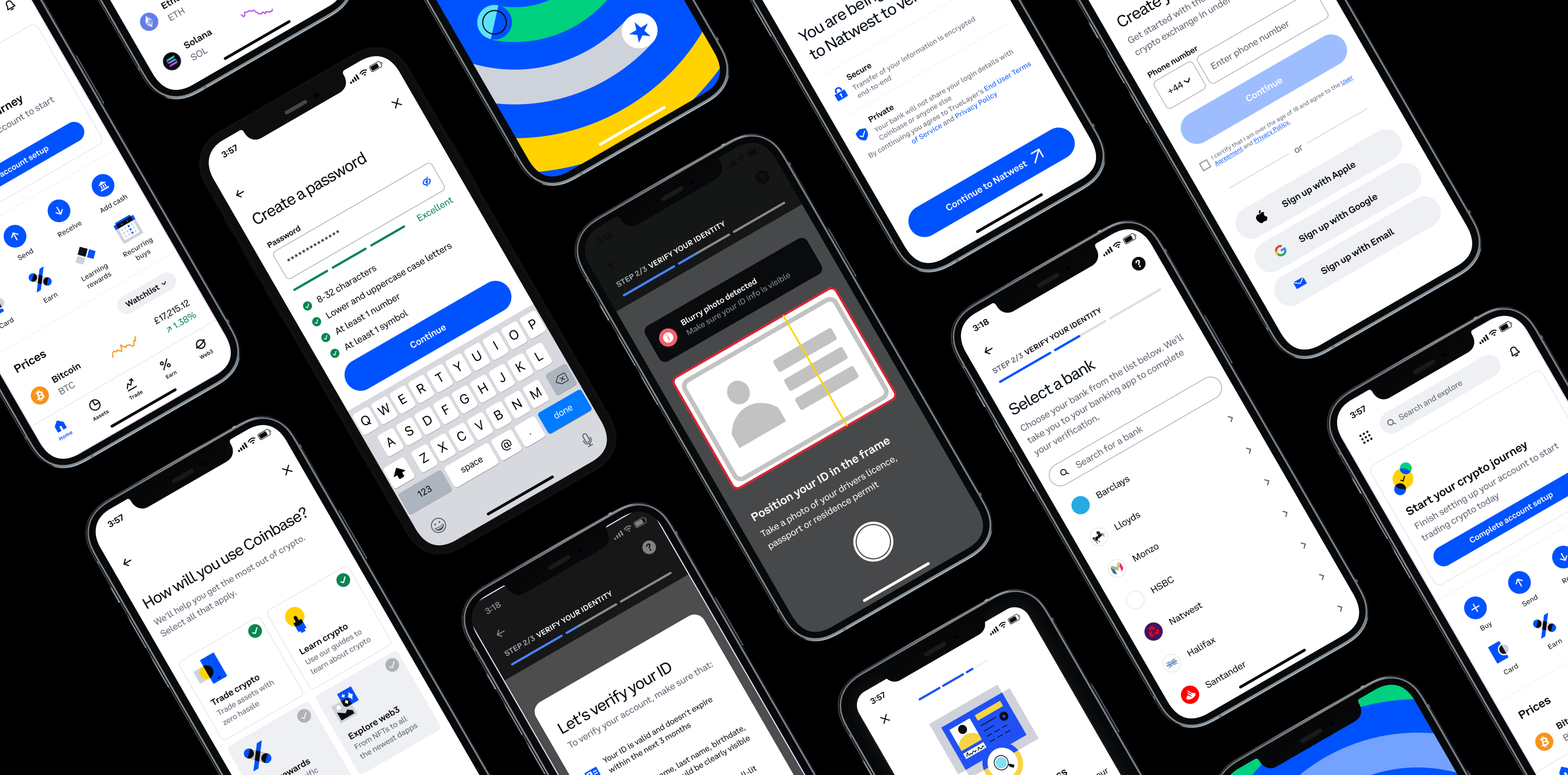

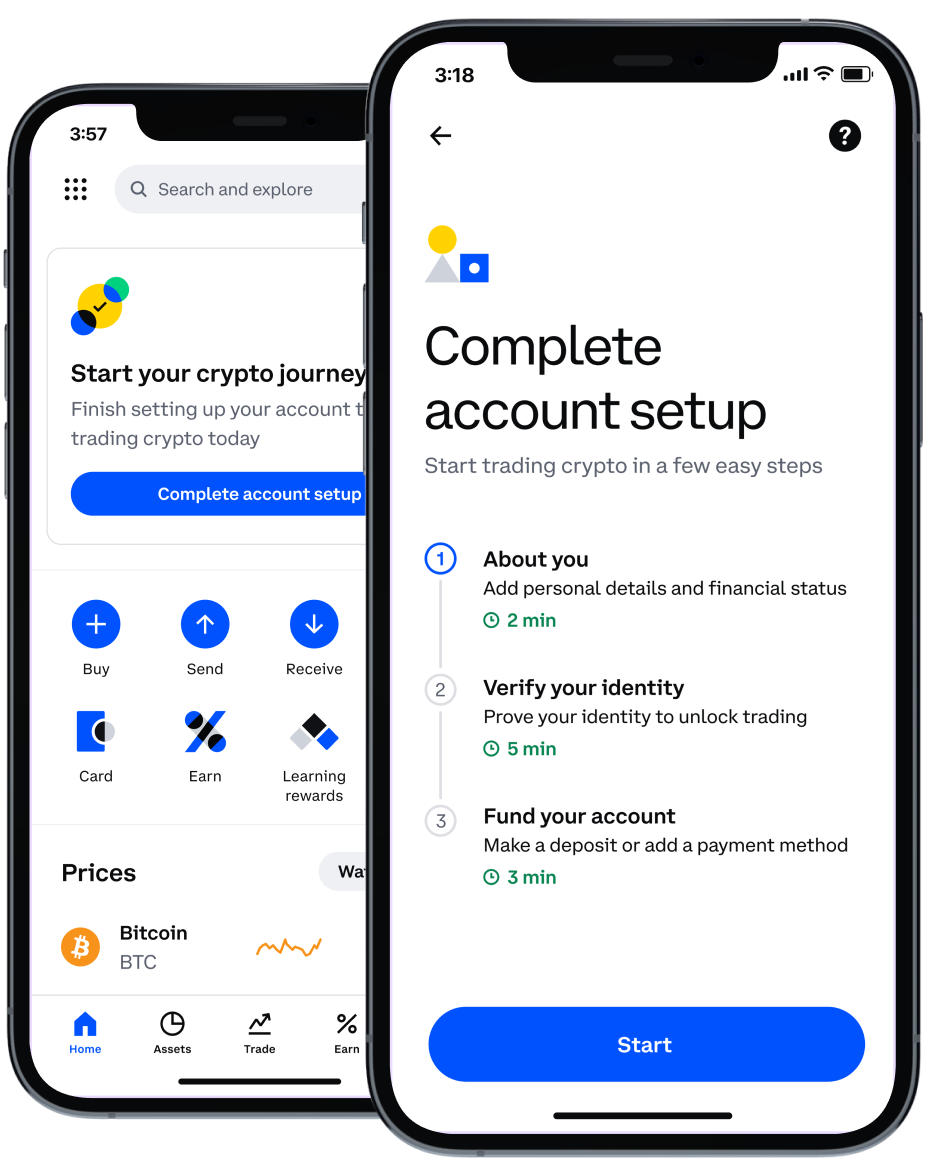

Coinbase . Fintech + Crypto . 2022-23

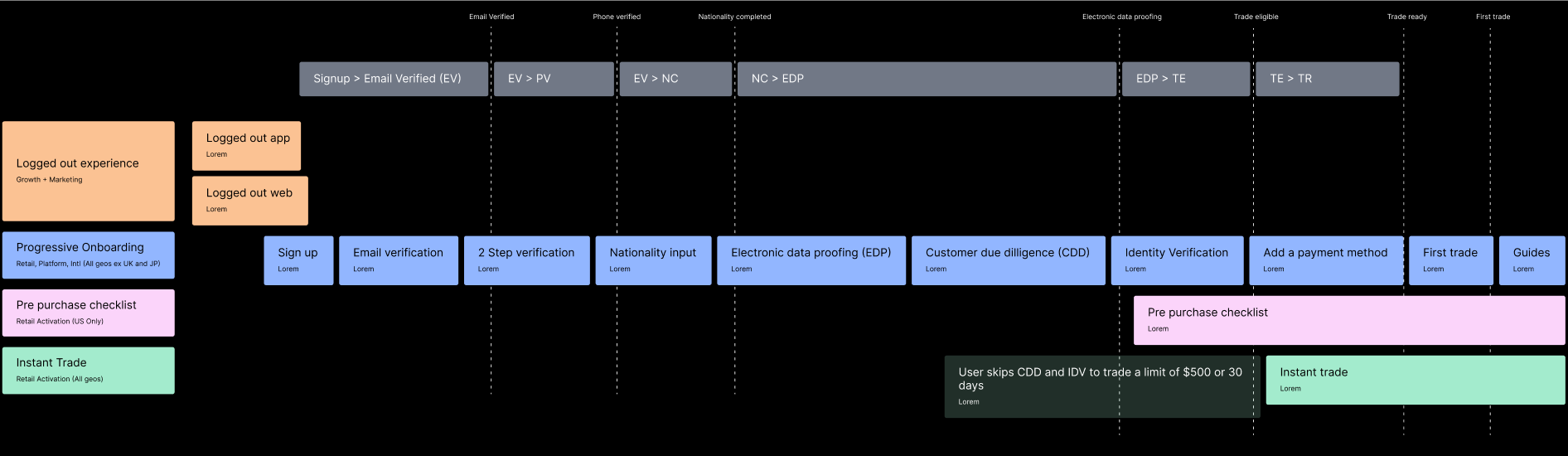

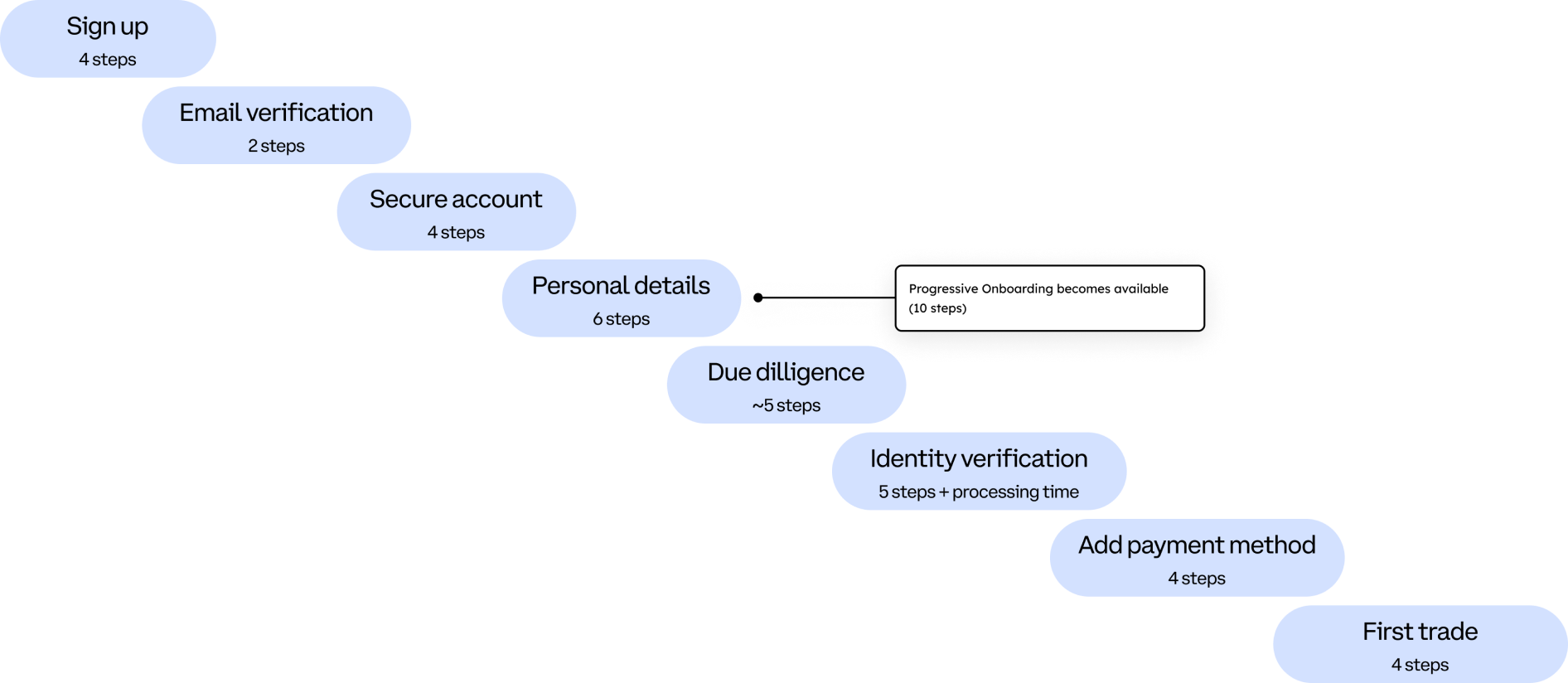

Getting a billion users globally for USA’s largest crypto exchange.

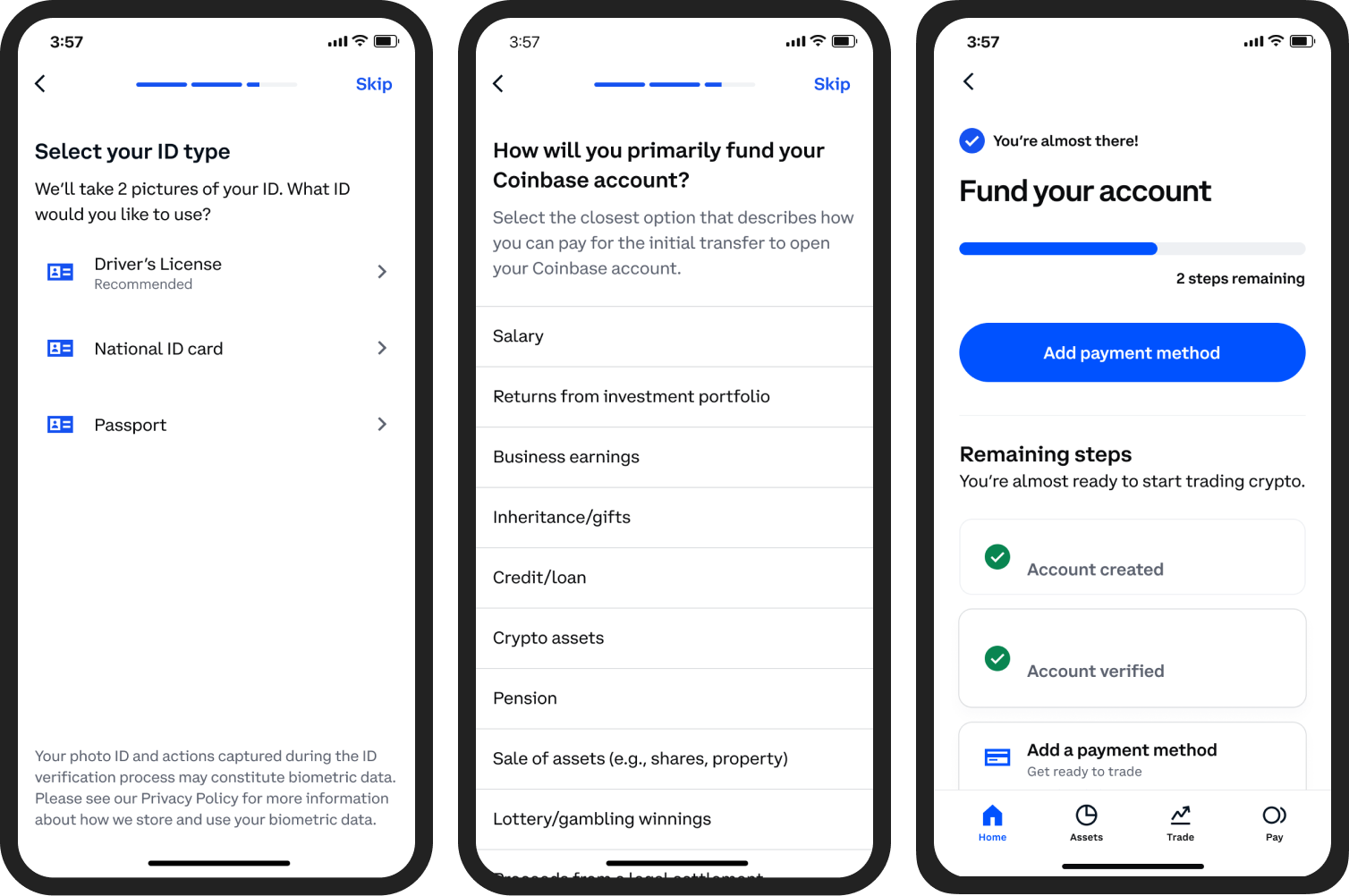

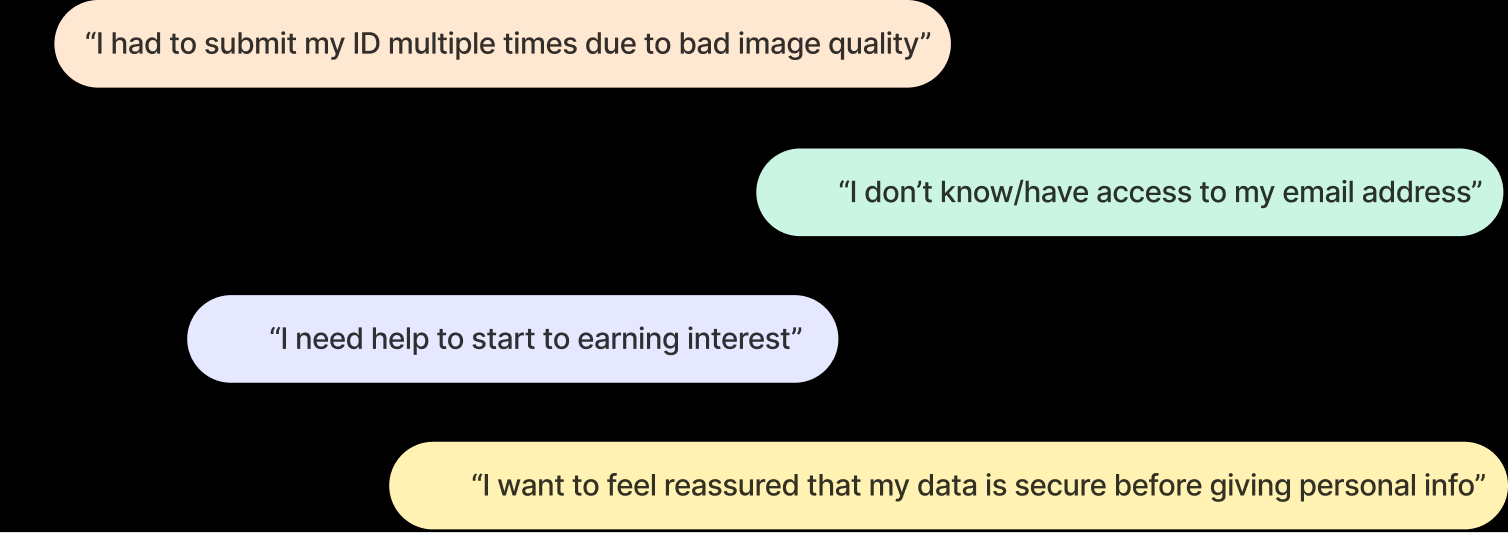

With increased regulator scrutiny and unfamiliarity around crypto, getting users to have a natural orientation and building trust to onboard new users became the key effort of the organisation.